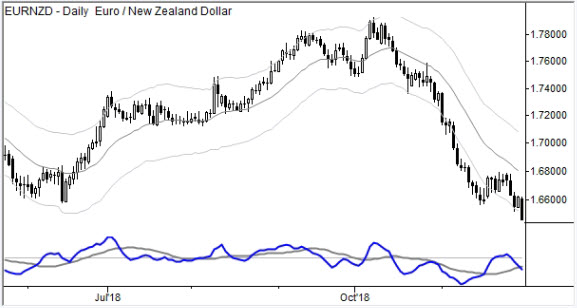

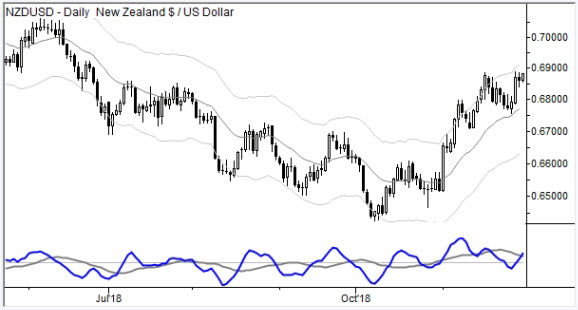

Why were we focused on NZD trades?

A week ago, I pointed out trade setups in NZDUSD and many NZD crosses to my MarketLife and Talon clients.

Of course, one issue currency traders need to consider is correlated risk; if you take a bunch of trades driven by one particular currency (even if that currency is the USD!), you don't really have "a bunch" of trades--you really have one big trade and one big basket of correlated risk. Those trades are likely to succeed or fail at the same time.

So that's a concern, but the lesson here, a week later, is why we were so focused on the NZD. The answer is simple: market structure.

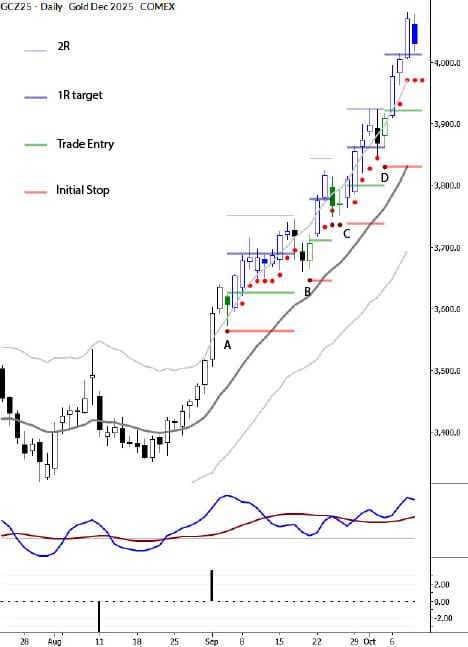

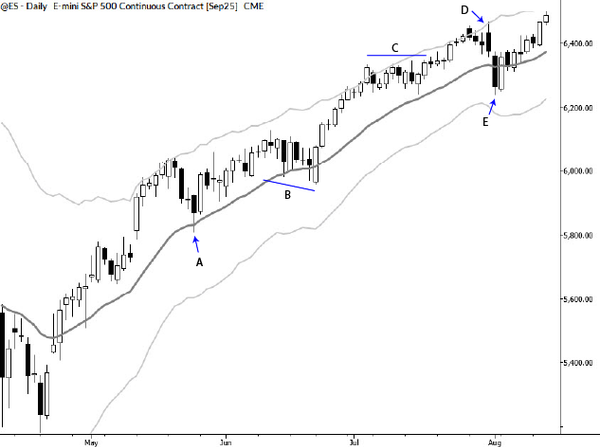

Take a look at the charts below, and see if you can see what I was looking at five days ago:

These simple flag patterns work. In a world where everyone is worried about HFTs, AI, and markets generally becoming untradable, this simple pattern continues to point the way to profitable trades--year after year.

I've built a career around this pattern. You can do. It's a major focus of my extensive, free trading course--start there and see what a difference an intimate understanding of this powerful pattern can do for your trading.