When to Trade (And When to Stay Out)

Markets are always a mix of signal and noise — the trick is knowing when the balance shifts in your favor. This post breaks down how to spot those rare moments when an edge appears, and when to stand aside to avoid bleeding money in choppy conditions.

The movements of financial markets are fascinating. There’s something hypnotic about them that can suck a trader’s attention in—this is one reason why some of us have spent thousands of hours watching charts! But there’s much more than meets the eye. Markets move for many reasons, and the movements of markets incorporate both the rational analysis and emotions of market participants.

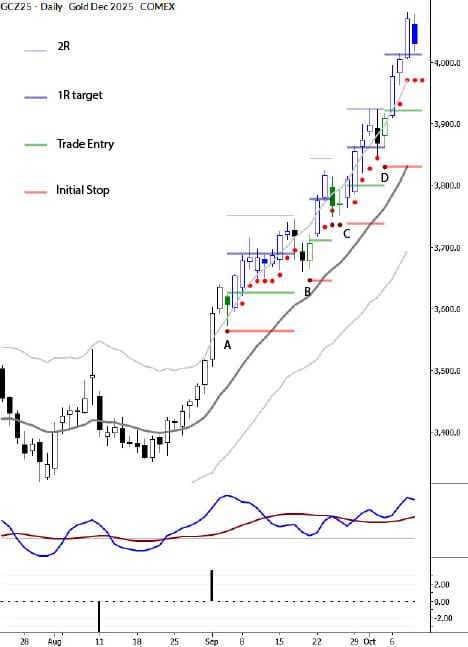

Market movements are made up of both signal and noise. The noise component can be thought of as essentially random and unpredictable. (We can tackle the statistical nature of that randomness in a future post.) The signal component, when it exists and if we can find it, gives us a slight tilt for future market direction and/or volatility. As technical traders this is what we must have if we’re going to place a trade.

Signal and noise exist together, always in a mixture. In some cases, the noise almost completely dominates. When this happens, the market will move unpredictably, and we’ll very likely lose money (at least to transaction costs) if we trade. As a technical trader your job really boils down to something like “place a trade if I have an edge. Otherwise, do not trade.”

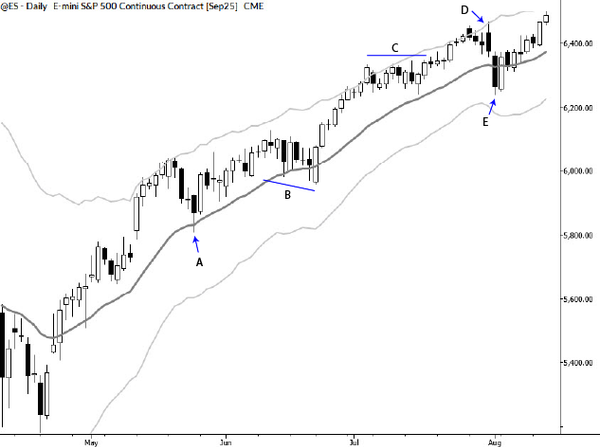

I’m writing this in the middle of the summer in 2025. In many markets, July-September is a notoriously low volume, noisy, and unpredictable part of the year. Many traders even take the summer off. This is well and good, but it’s not enough to just say “I’m going to wait for better market conditions to place a trade.”

First of all, we need to be able to define what those better market conditions might look like. Second, despite the fact that many asset classes are chopping sideways, there are opportunities in specific markets even now. So, we must know what to look for.

When a market is moving sideways, the forces of buying and selling are in relative balance. That’s a critical point: it’s the imbalance of these forces that suggests an edge might be present. Without an imbalance, we should probably sit on our hands and wait for better market conditions. When an imbalance is present, the odds start to shift.

Here is a short list of ideas I’ve found useful in identifying these shifts. You’ll need to spend some time with these to make them your own, and some of them might be more applicable in your trading style than others. None of these is a guarantee, but each has something to offer as we work to understand the ongoing balance of buying and selling pressure in the market.

- High short-term (1-3 bar) volatility relative to past volatility. Range is one of the cleanest measures here.

- High short-term volume relative to recent action

- Short-term trending action

- Multiple bars (candles) of the same ‘color’ in a row

- A series of large bars is better than a single bar

- A multi-bar move away from the average followed by a consolidation near the extreme of that move

- Touching a properly calibrated channel or band (simply a way to measure distance from the average)

- Bars increasing in range

- A “tail” on a candlestick at or around an obvious level

- Gaps

- A breakout from a visible chart pattern (which should show some of the previous characteristics)

- A failed breakout with good momentum

- Climax volume after a large move, especially to an important level

- Outside bar or some type of engulfing pattern