Taming the bear in the Russell 2000

Let me preface this by saying two things: First, I'm bullish on global stocks over even moderately long timeframes. Technicians like to call tops, but I think this bull market could have several more years in it. However, I'm also always looking for evidence that contradicts my opinions--this is a fundamental part of my investment process and how I think about markets. The Russell 2000 index has shown some behavior over the past week that should give stock bulls pause for thought.

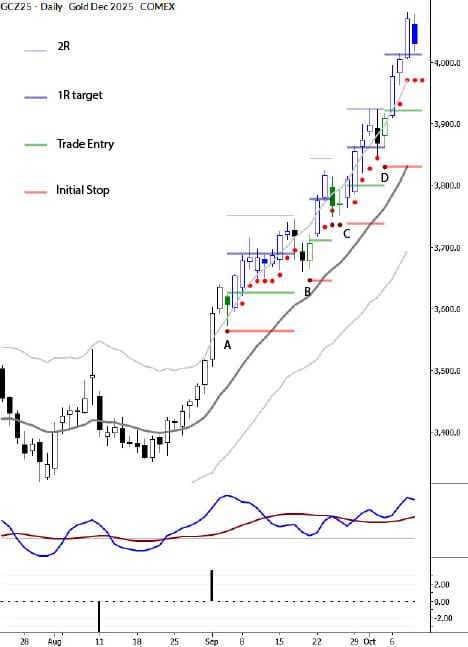

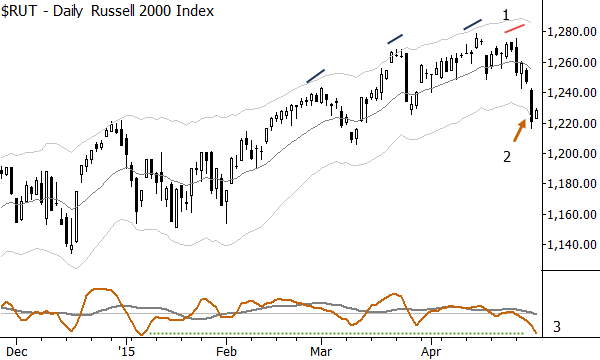

Take a look at the daily chart of the Russell 2000 (cash) index below. Three things catch my attention here:

- A series of highs that show weakening momentum, capped by a high that does not exceed the previous high. While not a dire omen, this is clear visual confirmation of waning bullish conviction over this timeframe.

- The market trades to the lower Keltner channel, the first time this has happened since the September/October selloff late 2014. When a market trades through the lower channel, there is enough downward momentum that the first bounce often sets up a short-term shorting opportunity.

- The modified MACD has made the lowest reading in many months. This is a "new momentum low", and also often sets up a short-term shorting opportunity.

Taken altogether, these factors are a caution to short-term stock bulls, but not a dire warning of an impending collapse. It's important to note when market action is inconsistent with the prevailing trend. Usually--far more often than not--factors like this are absorbed and the bigger trend continues after a few days or weeks with no issues; this is what we should expect here. However, longer-term trends begin to break down on shorter timeframes, so events like this are worthy of our attention.

How will we trade this? Most likely, by looking for a "reluctant bounce", and probably setting up a short into or out of that bounce. If the short trade fails, well, that's potentially very good news for the longer-term uptrend. Market analysis involves these kinds of checks and balances and tradeoffs. For now, perhaps our bullish conviction must be a little bit weaker than it was a week ago.

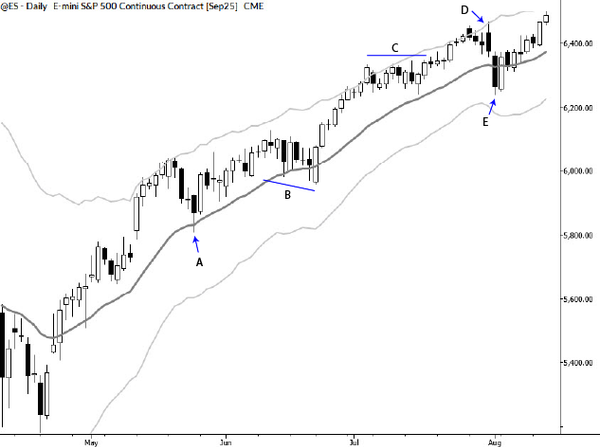

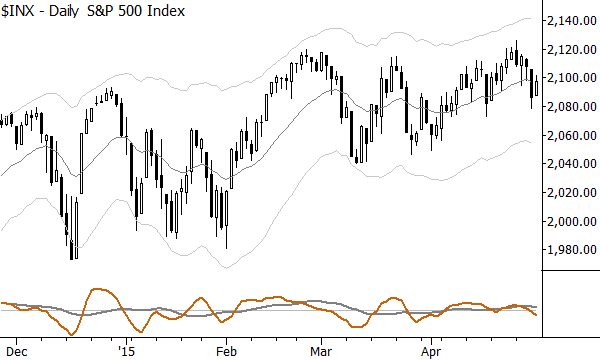

Last, this weakness is largely a mid/small cap factor. Take a look at the S&P 500 index, which shows only a "failure to go higher", and none of the sharp downward momentum in reaction from that failure. This is a picture of a much healthier market:

Remember, markets tend to seek trading activity, and, so, will often do whatever they can to hurt the greatest number of traders. In this case, a shakeout of weak hand longs could be healthy. We must keep an open mind, avoid emotional attachments, read the news with a skeptical eye, and, in general, seek to respond to the developing message of the market. For now, maybe the best stance is "bullish, but careful."