Surviving Isn’t Thriving: The Hidden Cost of Trading Less

When the trading gets tough, the smart trader… usually trades less.

Consider one of the most common mistakes of developing traders. (I feel completely qualified to write on any developing trading mistakes, and to call out how blisteringly stupid and destructive they are. Why? Because I made all these mistakes as I was learning—often more than once.) Overtrading, and its dear brother Revenge Trading, are reliable ways to destroy a trading account.

It's simple, really: a trader gets a little destabilized, usually by a larger than expected loss or a string of losses. It can also happen when a trader makes an error, and external factors are another common trigger. (I had a coaching client who would promptly lose double digit percentages of his account after a fight with his spouse.)

Whatever the trigger, the trader then engages in one or two related behaviors: either he trades more often or puts more risk on a trade. In the worst possible outcome, this is successful and he makes up for his loss or losses and goes to new account highs. Congratulations! He’s just learned a behavior that will guarantee his failure in the future because no one gets away with this consistently.

Though I made many dumb mistakes and repeated most of them more than once, I was at least lucky that the market punished me consistently.

The Right Thing to Do

So, what should a trader do? What’s the right thing to do in a period of underperformance? Following a big loss? When external stresses impinge upon our mental state?

The answer is simple: in almost all cases, you should be reducing your trading exposure, and removing chances for the market to hurt you. Maybe trade less often. Perhaps take fewer trades, but certainly don’t force trades. Maybe even trade smaller. In some cases, maybe even take some time away from the market. (But if you do this, make sure you are watching so you know when to come back!)

The idea here is pretty simple: things aren’t going well, so let’s not do more of what is hurting us.

Mathematically inclined students will object that each trade is a random draw from a probability distribution and that it’s illogical, and actually a serious logical fallacy, to modify your behavior based on recent results. They will say you just have to sit at the table and roll the dice. Some will even turn it on its head, proposing martingale-type doubling-down strategies to recover losses.

Fine, but the world’s not like that. Trading results are streaky. (For those mathematicians, I’ll say that trading outcomes often show serial dependence because they are conditional outcomes that rely on regime persistence: Trading outcomes do depend on the recent past.)

Here’s some practical advice, that may or may not check out quantitatively. But I can promise you it checks out in the three-decade long school of hard knocks I’ve been enrolled in. There are, broadly speaking, three reasons you will find streaks in your trading results.

- The mathematicians are right and it simply is the result of random draws. Purely random data is streakier in the outcomes than we’d expect intuitively. Humans have really shitty intuition about randomness.

- Maybe the market sucks. All trading strategies fit some market regimes better than others and really struggle in certain market regimes. We might just be in a period where your approach struggles.

- Maybe you suck (at least right now.) Various psychological factors and events conspire to keep us from reaching the pinnacle of our ability and success. If you’re underperforming because of you (and, for the record, when you’re considering reasons for a period of not-great trading results, I’d start here) then you need to break that cycle.

If the first of these is the reason, you really should continue trading. Correct analysis of results will give you the answer within the bounds of probability (and I wrote about this in my first book).

But if it’s one of the other two? Then chill out.

Reducing frequency and/or size of your trades is your insurance against ruin. But there's something else you must know.

The Dirty Secret No One Tells You

I suppose in today’s click-bait social media world, I should have led with what I’m about to tell you. I’m burying the lede here. FEW UNDERSTAND THIS! ONLY 320 IQ’S CAN UNDERSTAND WHAT I’M ABOUT TO TELL YOU! TRADING MENTORS DON’T TEACH THIS ONE THING!!!

Don’t worry, I’m more allergic to writing that bullshit than you are to reading it. But, in this case, it’s not really wrong.

Reducing your trade frequency reduces your ability to evaluate your results.

Yes, modifying your behavior so you don’t fly the plane into a big smoking crater is a good idea, but it also hurts you. When you have fewer trades, it’s harder to evaluate your performance. If you are reducing frequency because you’re in a slump (for whatever reason), then evaluating your results in that slump is going to be more challenging and less reliable.

Statistically, reducing your frequency slows learning. Statistical power shrinks as your number of trades shrink. Halve your trade frequency and your numbers (results) speak much less clearly. Formally, standard error increases by √2, confidence intervals expand, and it becomes much harder to see if you have an edge or not.

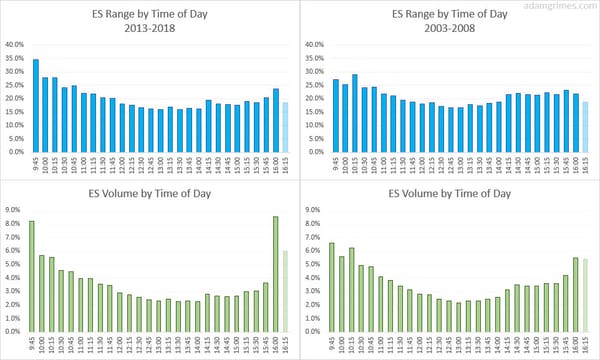

Trading time is not clock time. It’s event time. (It’s καιρός (kairos) not χρόνος (chronos), but that’s a topic for another post.) When you reduce your trade frequency you reduce your movement along the X axis of the graph that maps your growth as a trader.

So What to Do?

First, the old-school, common sense rule of thumb is good sense: when things aren’t going well, break the pattern and change your behavior. Don’t just keep doing the same thing while your account shrinks. And, for the love of all that’s holy, don’t increase size and try to get it back.

Here’s where a mentor can be helpful. If nothing else, having someone (who is not in your head!) evaluate your behavior can make all the difference. That mentor doesn't even necessarily need to have powerful insight--perspective is powerful itself.

If you're in a tough spot or the market doesn't favor your style, scale back your trading. Reduce size and maybe frequency. Only take the best possible trades.

But once you’ve made those changes, realize that you’ve turned the lights off. Everything is going to be harder to see, less certain, and more indistinct. You aren’t going to be able to tell as much from your trading results until you go back to trading normally.

Practically:

- Don’t lose sight of the market. Expend some energy looking at the patterns in the market more than your equity curve to evaluate when to go back to “normal” trading.

- Accept that your usual methods of evaluating your results are less reliable and that everything you see is less clear.

- Consider reducing size instead of frequency. This avoids the reduction in statistical power. If you graph your P&L in terms of R rather than dollars, that curve will still speak truth to you. (And it may still point downward, if the market conditions are responsible for your period of underperformance.)

This is the piece that no one, truly, talks about. Reducing trade frequency is sometimes the only way to stay in the game. Everyone knows that. Everyone tells you to do that. And they are right. It’s a good thing—a powerful tool.

But there’s also a cost to stepping back. You can't evaluate your results as well. Surviving is not thriving, but if you don’t survive you won’t thrive! This cost is not failure. It’s tuition. Pay it. Learn. Stay in the game. That’s how you build something for a lifetime.