MarketLife Ep 21 - Pulling the trigger: where, how, and why?

A look at how to execute trades: where they set up, and how, when, where, and why to pull the trigger--to make the decision to get into or out of a trade. Here are the show notes:

- Key assumptions:

- Most of what we see is random.

- I will be wrong a lot.

- So I can’t be emotional about being wrong

- I can be “wrong” can be for many reasons, most of which are beyond my control and knowing.

- Losing trades are a combination of "real" patterns failing and random garbage

- Application

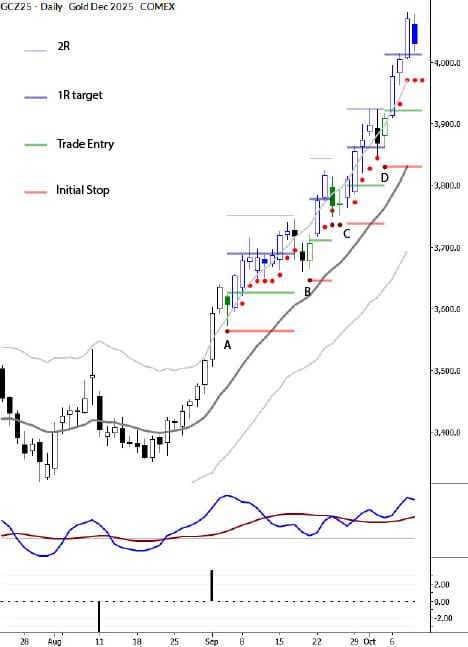

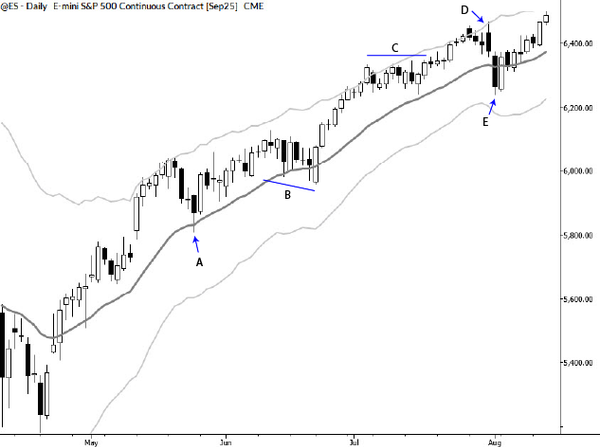

- Wait for a market to make a big move

- Bands and averages

- Tendencies around bands and averages

- How to use

- Bands and averages

- Decide mean reversion or momentum?

- Does it matter?

- Yes, but you could make a good argument that it doesn’t

- Can make $$ being long or short at nearly any point (can also lose!)

- Does it matter?

- Momentum

- Sharp move usually leads to at least one more sharp move

- A trending market is likely to continue

- Momentum against the trend is a problem

- Action following the move can help to separate

- Mean reversion

- Large moves are reversed

- Spikes out of non-trending markets tend to fail (meaningless statement? No.)

- Keep everything “smaller”

- Wait for a market to make a big move

- The actual entry

- Doesn’t matter as much as context

- Many books with numbered bars, but is this the best way?

- Identify context (potential) first.

- How to get in?

- Sorta doesn’t matter

- Breakout of previous bar

- Lower timeframe

- Previous close

- What matters a lot more:

- Correct risk

- Getting out

- Trade management decisions

If you enjoy the podcast, one of the very best things you can do for me is to leave me a review on iTuneshere.

Also, if you like the music for this podcast, then be sure to check out Brian Ashley Jones, my friend, and a fantastic singer-songwriter.

Enjoy the show: