MarketLife Ep 19 - Short term trading: what works for me

This episode continues my look at short term (intraday and daytrading) systems and ideas. Here are the episode notes:

What’s really happening intraday

- Academic studies of market behavior show departures from random walk on lower timeframe

- These are distortions, but don’t assume that this makes for easy trading

- Highly competitive and very noisy.

- There does not have to be “a guy” on the other side of your trade! <= This is one of the persistent misconceptions about trading.

Styles of daytrading

- In a way, nothing new here, conceptually. We have:

- With trend

- Countertrend

- Countertrend often requires scaling in against moves. “Fade traders”

Issues

- Whatever you're going to do, it's got to get done between the open and close. This brings some challenges regarding length of swings.

- It’s hard

- People exaggerate and lie (win ratio is a big one)

- Time spent at the screen vs. payoff. Would you do better with a longer timeframe?

- Be careful of marketing hype.

My experience

- Scalping was a dead end. Maybe someone is doing it, but I haven't found that person.

- The less I did, the better.

- Having a daily setup/gameplan is critical (maybe trade against that plan!)

- Both with trend and countertrend approaches worked

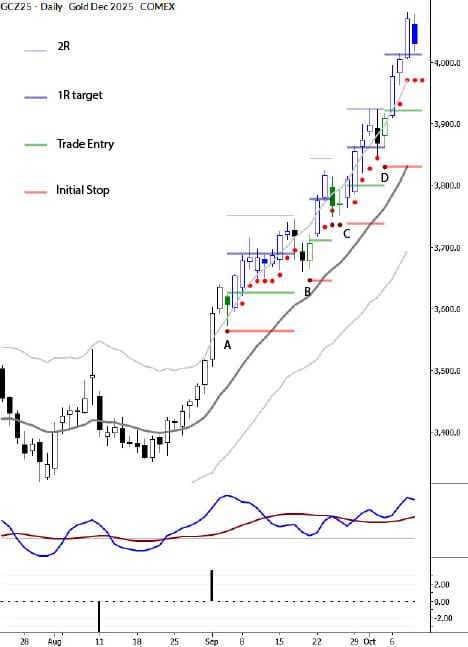

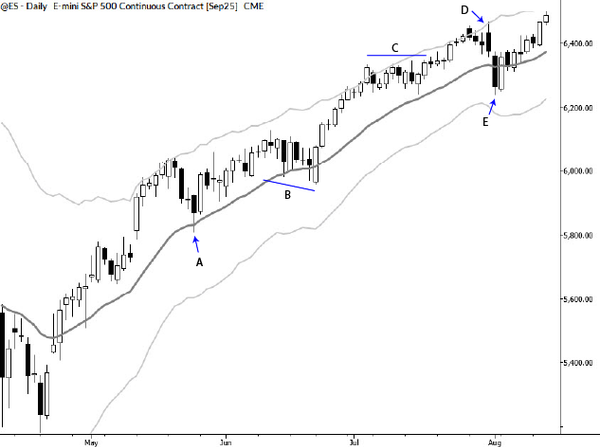

- Pullbacks

- Fading new highs / new lows during certain time windows

- Plays around the open

If you enjoy the podcast, one of the best things you can do for me is to leave me a review on iTuneshere. The reality of the modern publishing world is that user reviews and comments help build audience faster than nearly anything else, and I thank you very much for your help!

Also, if you like the music for this podcast, then be sure to check out Brian Ashley Jones, my friend, and a fantastic singer-songwriter.

Enjoy the show: