Hard Truths, Real Consequences: What It Really Takes to Trade

The truth will set you free—that’s the saying that has passed into everyday use from very old scripture. Sometimes, that’s true. But sometimes the truth can destroy us, especially if we try to deny it.

This is a good place to begin a series of posts, with the most honest thing I could put on paper. That truth is not something you are going to want to hear. It doesn’t make a great clickbait headline and it won’t encourage anyone to open their wallet to buy a course. But it has to be said, simply because it is the truth. And anyone who tries to trade will discover it one way or another.

Trading is hard. It will certainly be one of the hardest things you’ve done in your life, no matter your background. And I feel safe in saying that, as I’ve trained traders who had multiple PhDs, were professional major league athletes, successful executives with eight-figure retirement packages, and some who were successful entrepreneurs. Without exception, every person I’ve ever seen who learned to trade went through long periods of struggle, doubt, and failure before they eventually found success.

Why is trading so hard?

Markets Are Highly Competitive

The first reason should be pretty obvious. Markets do not exist so that you or I can make money to buy sports cars. Markets exist to facilitate exchange and to find value. So far, this is the best system we, as a species, have come up with to figure out what something is worth—buyers and sellers come together and vote on value. They do this with their money and by taking risk. It’s not perfect, but the force of free markets, driven by the actions of buyers and sellers, has transformed human society and culture.

But this means that people are always fighting it out in markets. It is always a fight. And the other participants often have more money and more information than we do. The person growing the commodity knows more about it than we do. Someone analyzing foreign currency may know more about likely political shifts than we do.

We’re always at a disadvantage and the market is always highly competitive. If it were not competitive, there would be no potential reward, so be glad for that!

The practical result is that edges (“ways to make money in markets,” for now) exist but they are small. Any edge you find is going to be only a small tilt in your favor. It is easy to miss, and it might even be fragile. We are going to win some and lose some and probably aren’t going to “crush the market” in one big winning trade.

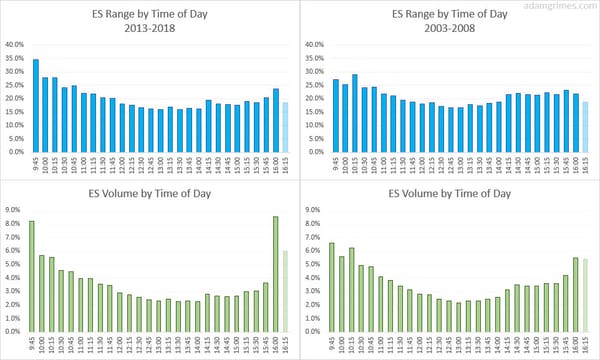

Markets Change

It’s also worth remembering that markets evolve, grow, and change over time. Some smart thinkers (Andrew Lo, at MIT, for one) have proposed that it even makes sense to think about markets as ecosystems with predators and prey, and an ongoing evolution of deception, camouflage, and hunting tactics.

The very first writings we have, on clay tablets in cuneiform, are accounting records—likely, records of trades. From literally the beginning of recorded history, buyers and sellers met face to face to fight it out in public. In recent centuries, this activity happened in dedicated trading pits (or under a famous cotton tree). Electronic devices soon supported these exchanges and then completely supplanted and replaced physical spaces for many markets.

The top-level changes are obvious, but markets are always evolving and changing. Change is very nearly the only constant. So, the bad news is that what worked yesterday may not work today or tomorrow. It can seem like once you figure it out, they change the game. When you do find those small edges, and figure out how to apply them, there’s no guarantee they will work forever.

Competitive markets can evolve trading edges right out of existence.

Right is Wrong and Wrong is Right

The market is not some magical unicorn designed to give traders profits. Quite the opposite. The market exists to take your money. The market is a fistfight with constant risk of escalation! The changes in prices we see come from humans fighting it out, and this fact hides another important truth.

Changes in market prices are the result of human behavior. Everything from hope, to greed, to excitement, to fear—the full range of both human logical analysis and emotional reactions combine to move markets. This means that market actions encode human behavior. Remember, markets are competitive.

So this means, far more often than not, if you do what feels natural or right you will find yourself on the wrong side of the market. The easy thing is usually the wrong thing. (Unless it’s not, and a certain amount of experience is required to tell the difference.)

Almost no one is a natural trader. Finding your bliss, peace, and balance in meditation is not likely to make you a great trader. Other benefits may accrue from practices like that, and some of those benefits can support you as a trader, but here’s the ugly reality: the mindset required to trade successfully is usually strongly aligned against normal human behavior.

It would probably take a psychopath to be a “natural” trader. And one of the things successful traders must guard against is carrying some of those psychopathic tendencies back from a successful trading career to everyday life! (As I said, it’s going to be hard to extract clickbait headlines from this blog post!!)

As I said in my first book:

It is not so much that the market is against us; it is that the market sets us against ourselves.

The market makes us our own worst enemies. Knowing this is the first step to trading wisdom, and it also points the way to some interesting and successful strategies for finding the right mindset to support a long and profitable trading career.

The bottom line is that the market itself is hard. It’s tricky. There’s a lot of deception and there are games being played on levels most traders don’t understand.

But another problem is that there’s a whole industry of parasites around markets who want to take your money in exchange for false promises and hope.

Trading Educators

Earlier this year, I received yet another series of emails from a guy wanting me to publish his articles as guest posts on this blog. He offered to pay—at first, pennies, but then a fairly meaningful amount of money. He sent some sample articles, and when I said no, he continued on down the list of asks from doing a podcast with him to publishing him on X to co-authoring something with him. To be clear, this was someone under 20 who had just graduated from high school and who could not have had any meaningful trading experience.

Fast forward a few months and I get one of his ads on Instagram—he’s walking out in nature, being thoughtful and deep, and explaining how he doesn’t want your money; he just wants you to join his trading community for free. I, of course, screenshot this and sent it to Tom, my business partner and trading partner, with a note that said something like “look at this douchebag…” I immediately felt bad because I had drawn an unfair comparison. A douchebag is a piece of medical equipment that has legitimate use and real value, and I was being unfair to douchebags.

I get requests like this all the time. In my thirty years in the industry, I’ve been watching the online marketing landscape evolve. Several years ago, I noticed a huge uptick in the number of people who were asking to write guest blog posts or to be guests on my podcast. The first half dozen were curious, but then it became a flood.

Turns out, there was a “lifestyle coach” who was encouraging young people to make careers as trading gurus, and the first step in that journey for them was “hacking expertise”—trying to look like an expert just by standing near a real expert and hoping that some credibility would rub off. Next time you see one of these new gurus, do a little digging into the online marketing industry that is creating them. There’s an entire backdrop of books, courses, guru teachers, and message boards supporting an industry that is doing nothing more than flooding the zone with false promises.

There are other offenses here, and some teachers are even fooling themselves. There are people who, just by chance, bought some cryptocurrency years ago and benefited from the appreciation. There are people who specialize in very low-float stocks, who buy these stocks and then share the setups with their followers. The buying pressure of the followers makes the stock go up—some of the followers may profit and the guru certainly does as he sells the stock to late buyers.

How about options strategists who are basically taking leveraged long plays on stocks, while the market has been in a multi-year bull market? Some of these players have indeed made money. They may not have engaged in the careful introspection and evaluation of their results to realize that they don’t have something they can pass on to a student.

Why does this matter? Because false promises give developing traders false expectations. When they evaluate themselves against these false expectations, they are maybe too quick to label themselves failures and give up. If you’re told that all you have to do is trade this one simple strategy for 15 minutes a day and then you can buy a yacht, what happens when it doesn’t work?

I believe it’s far better to hear the truth—that trading is hard—even if it is scary. If you understand the challenge before you, the timeframe and effort needed to get to success, and what success looks like, then you’re much better equipped to win. It’s not a get-rich-quick scheme; it’s a real career with actual skills that must be developed properly. Then you can get rich, after doing all the hard work.

So Why Bother?

I’m guilty of many things, and one of the worst might be that I sometimes overemphasize the challenges of trading. In an effort to counterbalance the douchebag-fake-gurus, I sometimes come up with marketing copy that basically says “trading is really hard. Most people who try to do it fail. You might fail too. But you can try.”

While I’ve never actually sent an email or written a blog post with that content, I’ve probably come close! It’s worth asking why, if what I say is true, any sane person would want to trade.

Well, there are good reasons. Ironically, the false promises in marketing material are not actually false. It’s true. You can probably make more money as a trader than you can make in any other legal way. You can have financial security for yourself, your family, and, if you choose, your community. You can be the angel that makes a check show up in a mailbox when you hear a neighbor’s kid is sick or there is some other need.

If you’re wired differently and you want the problems that come with yachts, models, and bottles of Cristal, you can probably make the money for that as a trader. (Though I’d suggest there are better champagnes to be had in that price range, but you do you!)

And you can do this without going into an office or answering to a boss. (Though one successful trader I know said he started trading so he didn’t have to answer to a boss but he then discovered that the market was more of an executioner than a boss.) Once you have your approach nailed down, you may even be able to do what you need to do in a few minutes each day. So, no, the promises are not false.

What is false is the path. It’s not fast, and it’s not easy.

You’ll have to change yourself, probably in some meaningful ways, to be successful as a trader. But there’s good news there, too—the changes you make have the potential to bleed over, in a very positive way, to other aspects of your life. The economists call this a ‘positive externality’, and it’s real for many traders—better physical health, better relationships, more precise thinking and problem solving—all of these can flow from the right kind of work.

The Way Ahead

If this sounds daunting and maybe even intimidating, good. It should. Trading is the hardest game in the world; you’re playing against some of the smartest and best-capitalized humans on the planet. But it is possible to win at this game, and the rewards are probably even richer than you imagine.

This is the first in a series of posts where I’ll show you some of the paths forward. You do have to find your own way—we’ll talk about what that means and why it is true—but there are many things all successful traders have in common and some truths of the market that must be embraced.

In my next post we will look more deeply at what a trading edge is: how to find one, where to look for one, how to know when you have an edge, and what to do with it once you do have one. Without an edge, the best you can hope for is to lose money slowly.

Trading is hard, but successful trading is possible. You can win at this game. Traders come from all walks of life, all backgrounds, and cover the full range of personalities and temperaments. Removing false expectations and seeing with clear eyes through the industry’s lies—this is the path to success.