February update: meditation, support and resistance, and coding

I want to share an email I sent to my blog subscribers last week. If you don't get these updates, please sign up in the sidebar. There will be more goodies and opportunities offered in these updates over the coming months (there was an offer to alpha test the Python course in the email, and those tester slots are now filled), so do keep an eye out for emails from me! I edited the update a bit below, but I think the comments on action around support and resistance, as well as the upcoming meditation experience are important highlights.

Support and resistance are complicated subjects. Traditional technical analysis teaches that support and resistance are the most important concepts in technical analysis... Our work, and the success of our methodology, challenges much of this thinking. While most of the founding fathers of technical analysis extol the virtues of support and resistance, we might, with all possible respect, point out a few potentially confounding factors... Modern practice, codified in the formalized approaches of several certification systems for technicians, simply repeats these errors.

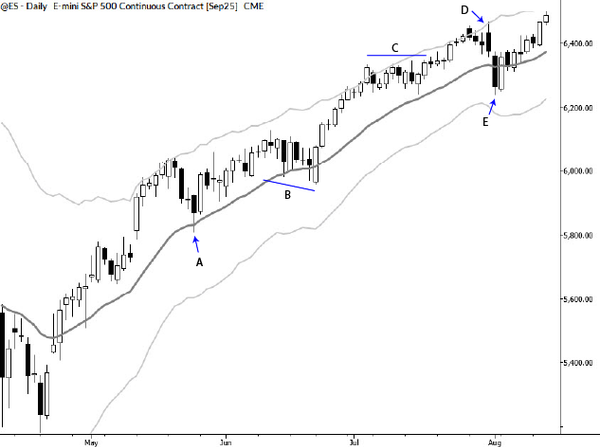

[Whenever markets decline, social media lights up] with dire warnings such as: “major support is about to break in US indexes!!!” The problem is, markets do not work like this. More often than not, support and resistance levels, when they have any meaning at all, act in a counterintuitive way. When stocks come down to support, that support will often be penetrated, and a quick recovery back above the level can be a good catalyst to take a long position.

So, while the rest of the world is watching for dire breakdowns of support, we encourage our clients to watch what happens when stocks engage those levels. (Use 1962 as a rough reference for S&P 500 futures, and 197.70 for SPY.) Ideal long entries would be set up by a day or two of weakness below those support levels, followed by quick recoveries, on the same or the following day, back above that support. We would look to buy the close back above that support, or the following open. Though this trade may appear to be counterintuitive, there is good long potential here, near the bottom of large consolidations. Fortune favors the bold, especially when the bold use correct stops and proper risk management.

Good trading,