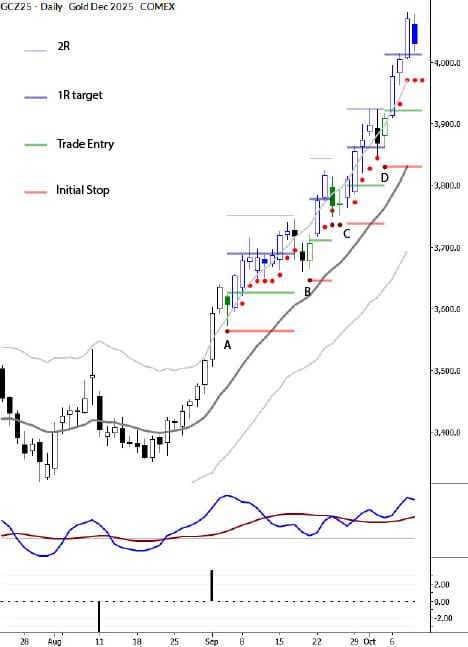

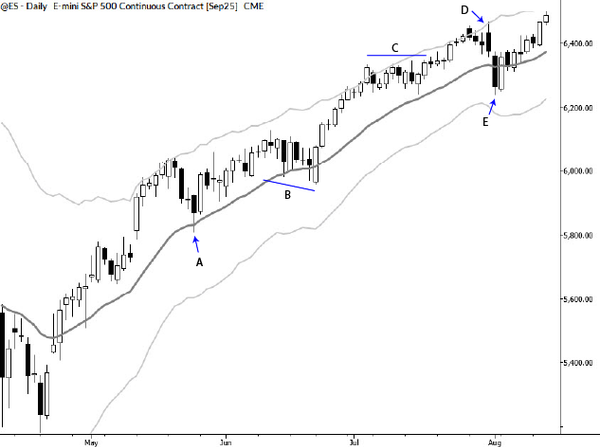

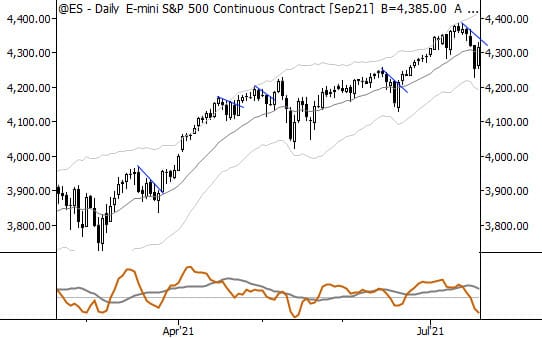

A look at some recent patterns

Summertime is here, and, as far as markets are concerned, it's been here a while. One of the characteristics of summertime trading is generally lower volatility and poorer followthrough.

Summer markets are not untradable, but they do require utmost discipline--any mistake will likely be severely punished. In some market conditions you can be a little "loose" and take trades that might not be very well set up. Not so here; markets like this only reward the most disciplined traders.

However, one thing that has always fascinated me is that the pullback is such a robust pattern it continues to work even as most trends dry up. Yes, you'll need to reduce expectations a bit. (We've found that taking full profits at 1R is a good way to play defense in this environment.) You'll need to consider your risk management and position sizing carefully.

But the core methodology still works.

Here are a few examples of pullback patterns from recent markets. In all cases, I've just drawn a line over the "business end" of the patterns--so the downsloping lines indicated bull flags and upsloping for bear flags.

Perhaps nothing revolutionary here, but a quick look at a pattern on which you can ground a trading plan.

click charts for full size