1/25/12 Chart of the Day

[dc]T[/dc]his pullback in Gold futures could offer an opportunity for a short. Positions could be established on a weak close, looking for a first leg to retest previous lows (1,525 - 1,540 basis February contract).

[dc]T[/dc]his pullback in Gold futures could offer an opportunity for a short. Positions could be established on a weak close, looking for a first leg to retest previous lows (1,525 - 1,540 basis February contract).

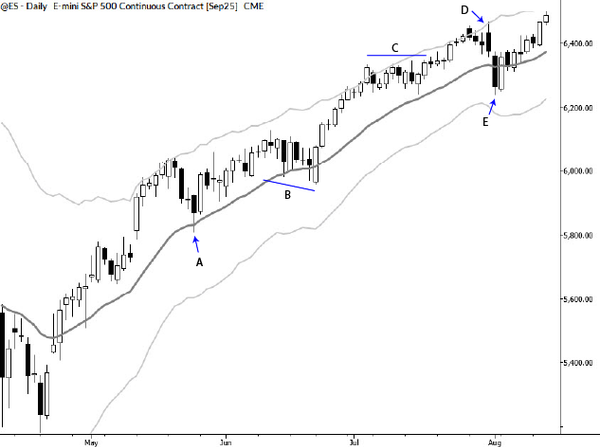

There are many ways to trade financial markets. Much of the struggle and confusion that traders face comes from not understanding their goals--not knowing how they want to trade. In some very real sense, from not knowing themselves. Gold (and precious metals in general) provides some good examples for traders

The truth will set you free—that’s the saying that has passed into everyday use from very old scripture. Sometimes, that’s true. But sometimes the truth can destroy us, especially if we try to deny it. This is a good place to begin a series of posts, with

When the trading gets tough, the smart trader… usually trades less. Consider one of the most common mistakes of developing traders. (I feel completely qualified to write on any developing trading mistakes, and to call out how blisteringly stupid and destructive they are. Why? Because I made all these mistakes

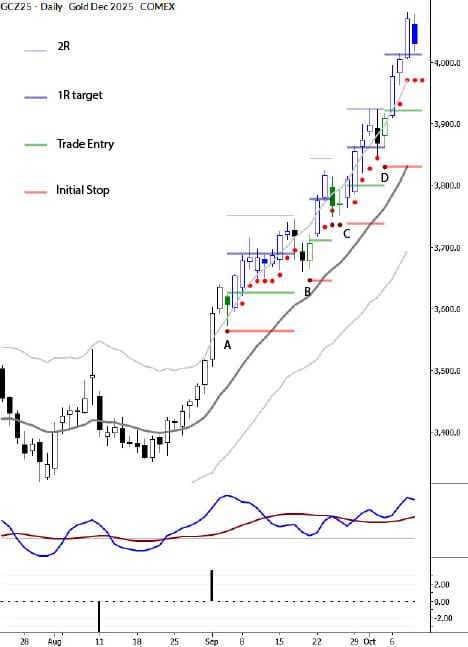

Just a quick look at patterns and concepts applied in an actual trade. This was a trade that was shared with our MarketLife members in advance. Trades like this are easy, but only if you're looking in the right place at the right time. For context, trading has