Trading a Powerful Trend in Gold

There are many ways to trade financial markets. Much of the struggle and confusion that traders face comes from not understanding their goals--not knowing how they want to trade. In some very real sense, from not knowing themselves.

Gold (and precious metals in general) provides some good examples for traders here at the beginning of October 2025. Looking at a chart, gold has gone "straight up", and you can't open a social media platform without seeing someone bragging about their recent gold trades.

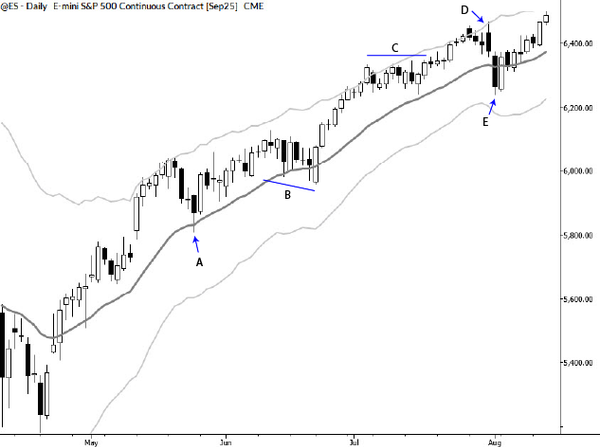

From a technical perspective, this is a pattern I call a "slide along the bands" trend. These trends are very strong, can go much further and longer than expected, but they also bring special challenges. I've written extensively about these trends (two posts here and here) for many years. As you can see, plus ça change, plus c’est la même chose.

Trading a trend like this is not simple. Add at the wrong spot and you're in a position of weakness. Get shaken out with a stop too tight, and you can't get back in. For many traders, markets like this are a seething battleground of all the various fears traders face--fear of missing out, of losing, of volatility, and even of looking stupid! (As someone who has recorded daily market analysis every day since 2009 you'd think I'd be over that last one, but we're all human.)

The answer is a precise methodology and trade plan. Know how you are going to trade a market like this--whether you are going to be a sticky with-trend trader or a targeted clean-move swing trader. For the trades we publish for our MarketLife clients, we focus on only being in a market for the cleanest moves.

Real-time trades

Take a look at the chart above. I'm highlighting four recent swing trades we published for our MarketLife clients. All of this work was done in real-time, the night before, with no revision. This is how it works. The bars are color coded:

- Green: long setup, likely entering on a breakout of a previous key level

- Blue: Long position underway, assuming trade entry

Stops are indicated by colored dots. Dark red dots are proposed initial trade stops, and red are the trailing stop levels we publish every day.

Brief commentary on each trade:

A: This was the first powerful move up after a long period of sideways action--classic "base-building" technical behavior. You can certainly trade the breakout that creates this move, but our focus is on catching the first pullback, which we did well here.

Advice to the wise: if you're going to take the first pullback after a powerful thrust, you have to be aggressive. You may be in too early. But the best pullbacks really only give you a bar or two to get in. (Inside bars are your friends here, but you can't choose what the market gives you!)

B: Our goal is to be in for a clean move, which dictates where we place trailing stops. Our stop was hit, but we reloaded with a new potential entry after the pullback pause.

C: Lather. Rinse. Repeat. Here a doji + inside bar combination gave a very clean trend entry.

D: I hope you're a little bored by now. I'm just showing you great trades based on the same pattern. But this is good news--this is a repeatable pattern that you can put to work for yourself!

Full disclosure

Lest you think we fumbled with silly entries before this, here is the full list of our trade calls for gold futures this year. (These could have been traded on GLD for stock traders who prefer to use exchange-traded products.)

- 03/06/2025 - 03/10/2025: Long setup (no entry)

- 03/12/2025 - 03/21/2025: Long

- 03/27/2025 - 04/03/2025: Long

- 04/16/2025 - 04/23/2025: Long

- 05/06/2025 - 05/07/2025: Long

- 06/02/2025 - 06/06/2025: Long

- 09/05/2025 - 09/17/2025: Long

- 09/22/2025 - 09/24/2025: Long

- 09/26/2025 - 10/02/2025: Long

- 10/06/2025 - ??? : Long

I also realize the chart is a little busy, so here's a cleaner version of the chart without the trade geometry for each trade:

Trends like this aren't common, but catching one can make all the difference. Moves like this reward discipline, patience, and usually pay traders who have a clear trade plan. The challenge is always the same: recognize the conditions that can produce a trade like this and trade the structure as long as it holds.

If you'd like to see how we find setups like this in real time, get access to my latest thinking on markets--along with many "Chart School" lessons each and every week--I'd like to invite you to take a look at MarketLife. Markets are always moving. Let us show you how to turn chaos into opportunity.