Pullback

Chart Reading Isn’t About What’s Right. It’s About What Works

What’s the right way to read chart structure? That’s the wrong question. This post explains why context and utility matter more than correctness in trading charts.

Pullback

What’s the right way to read chart structure? That’s the wrong question. This post explains why context and utility matter more than correctness in trading charts.

General Comments

Every day, I provide detailed market analysis for MarketLife members, focusing on daily setups. We focus primarily on the daily timeframe, and cover markets in two tranches: US-listed futures (and currency futures), and US stocks. We focus on directional trades that are drawn from my work, which you can find

Pullback

There are many things I love about the markets. Yes, I love the idea of getting paid for solving the puzzle or playing the game. I love learning. I even love being proven wrong when it points me to new growing edges and new areas to explore. But maybe most

Anti

Were you caught off guard last week? Did you expect the market to do something it didn’t do? One of the most reliable, recurring market patterns is the concept that sharp impulse moves followed by a quiet period usually lead to another move in the same direction. Recent action

Pullback

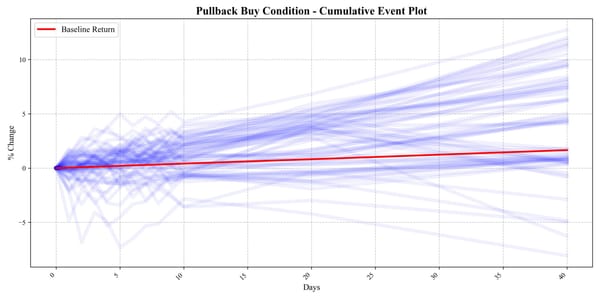

Pullbacks are a great way to trade. But, with any trade, the problem is that some trades work and some don’t. There are ways to tell which pullbacks are more likely to lead to winning trades, and one of the best ways is to put the setup in context.

Anti

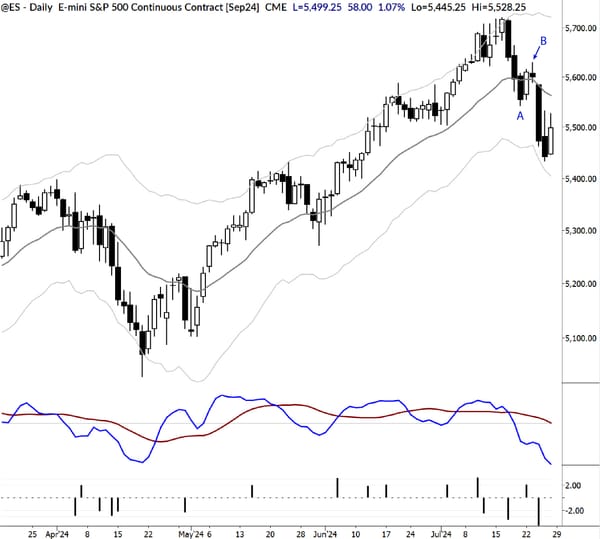

Today, I want to share a trade in the S&P futures market. Here’s what I hope you’ll get from this short blog post: * A deeper understanding of the snap pullback * A real-world example of that trade, with thoughts on setup, entry, and trade management * Some thoughts

Pullback

Sometimes I think the world probably does not want to see yet another blog from me illustrating yet another basic pattern… but these “basic patterns” can be wildly profitable. You can build your entire trading career around this one, simple pattern. The attached chart shows a recent pullback in 10

Pullback

Summertime is here, and, as far as markets are concerned, it's been here a while. One of the characteristics of summertime trading is generally lower volatility and poorer followthrough. Summer markets are not untradable, but they do require utmost discipline--any mistake will likely be severely punished. In some

Pullback

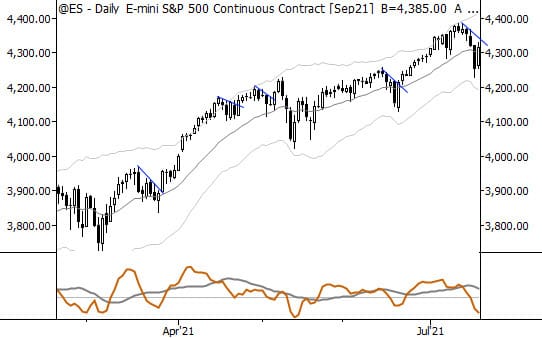

One of the key questions that comes up with developing traders is “how do I get into trades? Where exact do I enter?” On one hand, the answer to that is that it really doesn’t matter that much—if you get direction right (meaning you can read market structure

Pullback

This morning, Tom says to me "Cryptos are looking like good shorts." He's right. Take a look at the daily chart of Bitcoin Cash: * Recently broke below a channel with a clear support level. * That breakdown was on good momentum. How do we measure that momentum?

Chart of the Day

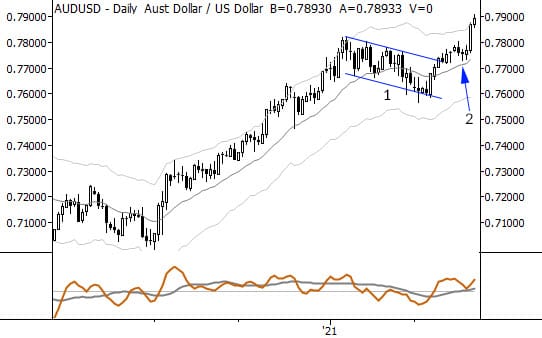

Here is a trade setup we published today as a MarketLife TradeLab, available to both MarketLife Premium and MarketLife Plus subscribers. We are also offering a lifetime 20% discount on MarketLife. Use the code SPRING19 and sign up today. After offering trading opportunities on both the long and short side,

Pullback

Just a quick post here, under the heading of “simple things work.” Take a look at the chart of the USDCAD below. This is a picture perfect short setup, and there are several lessons we can take from it. The setup There are a few key components to the setup.